Loading...wait, please

Loading...wait, please

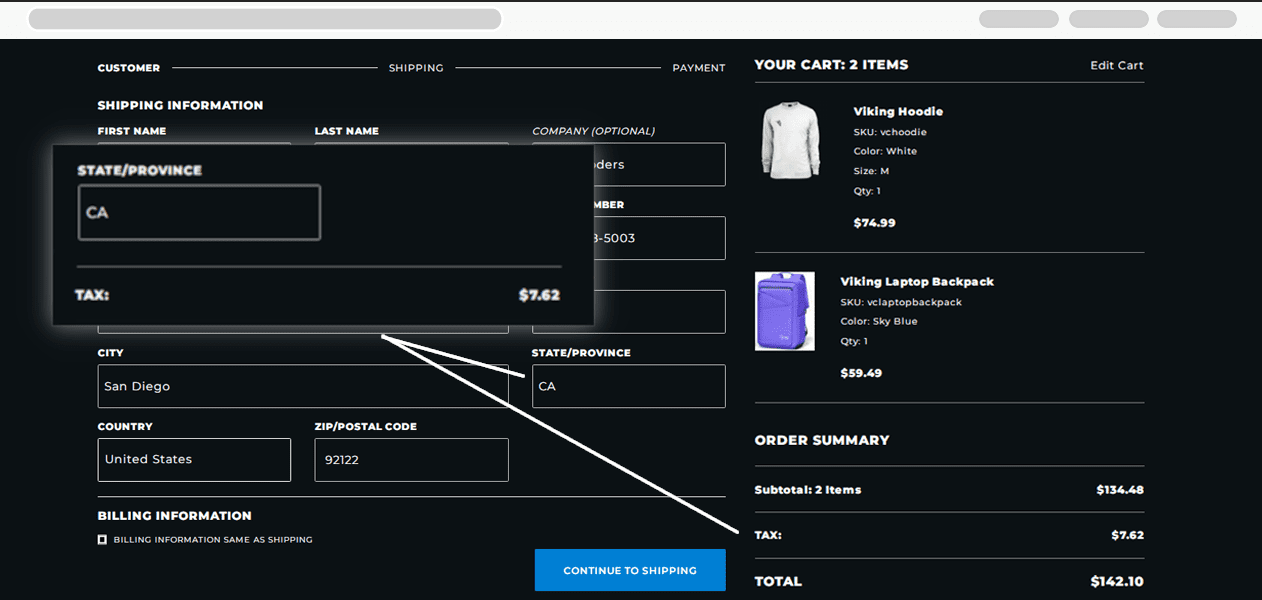

Nobody enjoys paying taxes and yet we do it — and we better do it right. IRS audits are everyone's worst nightmare so a comprehensive tax solution that ensures accurate rates (at all times!) is a must.

To make it more fun, all 50 of our great US states have different rates that adjust regularly. To top it off, county tax rates are often different from the state's.

So how do you stay on top of it?

The latest rates are published once a month and we stream them straight into your store. No fancy API calls to make for every calculation (that can slow down your checkout), no downtime to your store when the tax system all of a sudden stops working. Instead, a seamless tax calculation, with no added friction.

Easy-to-use admin interface in your Miva, PrestaShop, or Magento store, with all the exporting and reporting features to suit your needs.

You probably already know that states have thresholds before you begin collecting sales tax. Example: California's threshold amount is $500,000 in sales, whereas in Florida that number is $100,000. States also look at the number of total transactions. Viking's Tax Data Systems can set and maintain those thresholds automatically for every state.

Now let's talk about cost:

Tax Data Systems is different from other products Viking offers. Generally speaking, tax solutions offer no ROI. Shoppers don't want to pay taxes and merchants receive no benefit from them. Yet, Uncle Sam makes us do it.

Our view on it is you shouldn't have to pay the premium to follow the law.

Our Tax Data Systems is a comprehensive, enterprise-level solution without the hefty price tag charged by our competitors.

Here's the breakdown:

Trusted by our clients since 2012!

Got a Project or an Integration in Mind?

Viking Coders 9100 Conroy Windermere Road, Suite 200, Windermere, FL 34786

(800) 578-5003Viking Coders 49100 Conroy Windermere Road, Suite 200, Windermere, FL 34786

(800) 578-5003